How to Plan for Retirement While Keeping Long-Term Needs In Mind

Retirement is supposed to be the time when you finally get to kick back and relax. However, sometimes the unexpected happens, and it’s important to plan for that sort of thing. You or your spouse might find yourself sick or injured and in need of long-term care, as scary as that might sound.

If unfortunate events happen, this shouldn’t be a hindrance to your golden years. With the right amount and types of planning, you can still take advantage of the comfort and relaxation you’ve worked so hard for. Today, Rodney Brooks offers some advice to help you plan, even if the unexpected occurs.

Anticipating Your Needs

No one wants to think they will need long-term care in their future, and with the rising cost of long-term care insurance, it is hard to know if it’s actually worth the price tag. However, according to Fidelity, if you do end up needing LTC, insurance can be an invaluable investment. Even if it’s uncomfortable, it’s important to take some time to sit down with your spouse and decide if it would be worth the investment.

The best place to start is with your current lifestyle. Talk to your doctor to see if you are keeping healthy enough habits, and discuss if any poor past habits might affect your future. Even if you’re just starting now, focus on keeping a healthy diet, commit to exercising, and reduce risky behavior.

Also talk to your physician about catching and preventing illnesses. For example, fending off osteoporosis by eating calcium- and vitamin D-rich foods will protect your bones should you fall, while improving your physical activity level and losing excess weight protects you from blood pressure disorders that can lead to heart attack and stroke.

It’s also a good idea to look into your individual family histories – this is a key factor in determining your likelihood of health problems down the road. How your ancestors fared as they aged could provide hints as to what you are predisposed to. If they needed long-term care for an illness or injury, the chance you might need LTC may increase.

A Safe and Healthy Home

Another great place to look to reduce risk is in the home. Older adults are opting to age in place. While this can provide a great deal of comfort, the home can present serious risks of injury. Consider investing in home modifications to reduce the risk of injury.

Go room by room and assess the safety and risks, which will help you determine what types of modifications need to be put into place. Some modifications like grab bars you can install yourself.

If after assessing risks you determine your home isn’t safe, consider downsizing into a more accessible home. Research home prices in your desired area and look for homes that meet your needs. You can use a home affordability calculator to estimate how much you can spend on a home.

There are also a few relatively simple investments that you can incorporate into the home to assist in safety and security. For example, smart home tech can help you stay comfortable at home longer, such as a front door camera that you can use when visitors come knocking; instead of getting up to check on the door you can see who’s there from the couch. And when it's time to troubleshoot issues, you can refer to online resources.

How to Cover Expenses

The cost of long-term care continues to rise as years go by. As a result, it's a good idea to estimate what type of long-term care you might need. There are many options to choose from and they all come at different price points, from home health aides and adult day care to assisted living and nursing homes. Decide which type of care is best for you.

Even if you have saved enough for retirement, your savings might not be enough to cover all your expenses out of pocket depending on the level of care required. If you plan to rely on Medicare, do your research. There are Medicare plans (like Medicare Advantage, for instance) that can help cover other expenses like dental care and prescriptions, which will assist you in focusing on saving for long-term care costs.

FinancialPlanning recommends looking into alternative funding options for long-term care. This includes long-term care insurance, life insurance hybrids, as well as annuities. You may even consider generating some extra income with a side business you can do in your spare time. There are plenty of ways to think creatively about the type of work you could pick up.

Plan Ahead

While it may not be fun to think about, taking the time to properly plan for your future is well worth the investment. Anticipate your needs and consider where you’ll live and how much you’ll need to retire. You do not want to suddenly find yourself in a precarious situation without one. Doing the legwork now will save you the heartbreak and stress of being forced to make up a plan on the spot. Instead, give yourself the space to get the care you need and deserve.

Rodney Brooks is here to help you take charge of your finances. Feel free to reach out with any questions!

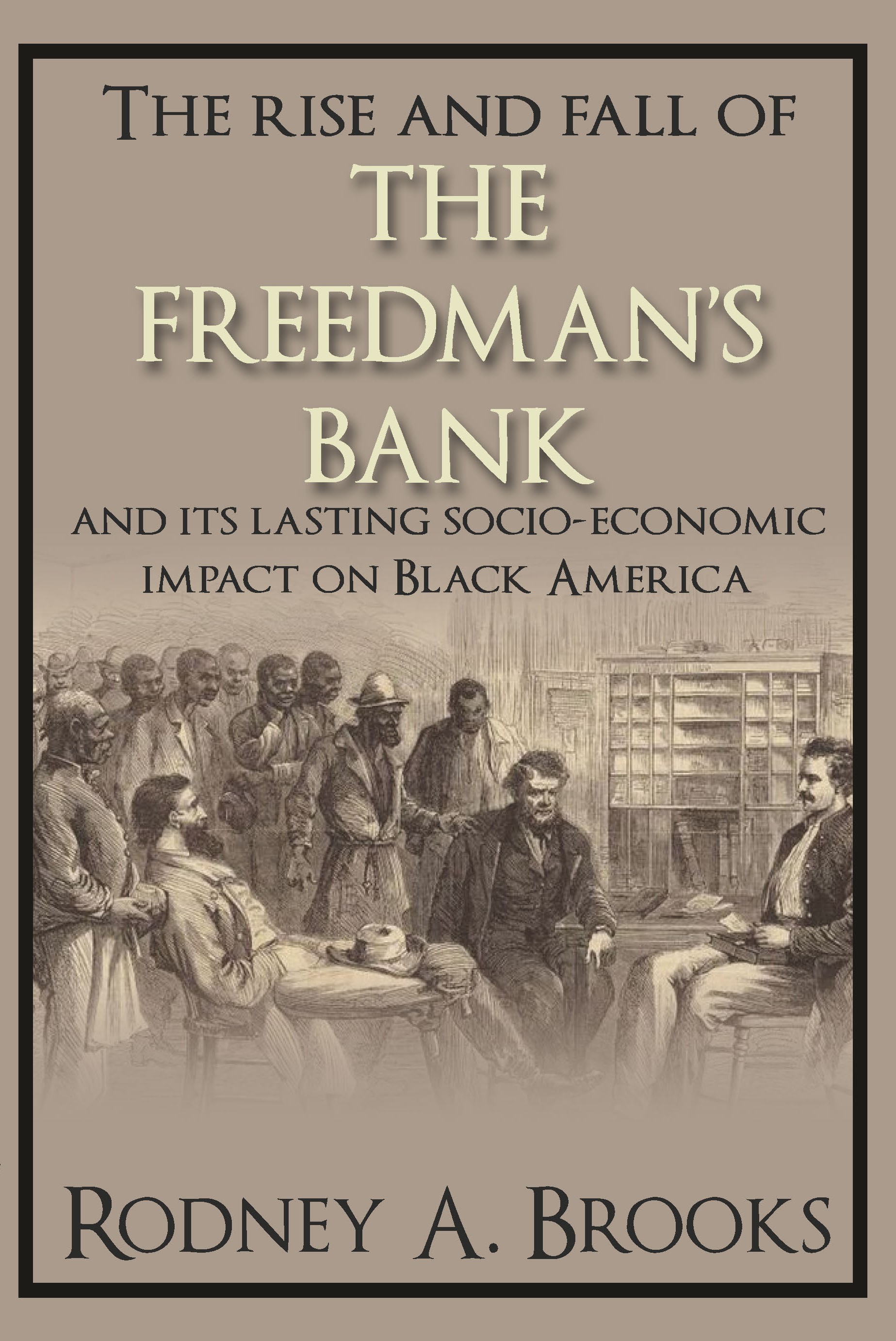

The author tells the history of the Freedman’s Savings Bank, how it grew much too quickly, why it failed and the impact on Black America. The Freedman’s Bank offered a safe depository for formerly enslaved people, expanded quickly and gained millions in deposits – mostly ranging from $5 to $50. But inexperience and corruption doomed it to failure, costing may of the small depositors their savings.

The author tells the history of the Freedman’s Savings Bank, how it grew much too quickly, why it failed and the impact on Black America. The Freedman’s Bank offered a safe depository for formerly enslaved people, expanded quickly and gained millions in deposits – mostly ranging from $5 to $50. But inexperience and corruption doomed it to failure, costing may of the small depositors their savings.