Thrive in the Downturn: Turning Recession Chaos into Your Comeback Story

Recessions are like unexpected thunderstorms — they may drench everyone, but not everyone gets equally soaked. While some panic, others grab an umbrella, find shelter, and even plant seeds that grow once the rain stops. This guide explores how you can not only survive but thrive when the economy turns gray.

Action Items

- Stay calm, stay smart. Panic leads to poor decisions.

- Diversify income streams. Gig work, freelancing, or side hustles can buffer job loss.

- Upskill and reskill. The best protection is adaptability.

- Manage cash flow carefully. Budget ruthlessly and prioritize essentials.

- Spot the silver linings. Recessions can open doors for those ready to walk through them.

Recognizing What’s Really Happening

A recession isn’t just an economic term — it’s a behavioral shift. People buy less, companies tighten budgets, and fear becomes contagious. Recognizing these patterns early helps you respond rationally rather than react emotionally.

Resource: Federal Reserve’s Economic Education Resources offers approachable explanations of cycles and market changes.

The Adaptive Playbook: How to Move Smartly Through a Downturn

The 5 Rs of Recession Readiness

- Reassess: Look honestly at your finances. What’s flexible? What’s fixed?

- Reduce: Cut unnecessary subscriptions or luxury spending.

- Rebuild: Strengthen emergency savings — aim for 3–6 months of expenses.

- Reinvent: Consider learning new skills or pivoting roles.

- Reach out: Networking often leads to unexpected opportunities.

Try Mint’s Budget Planner or YNAB (You Need A Budget) to visualize spending patterns before making cuts.

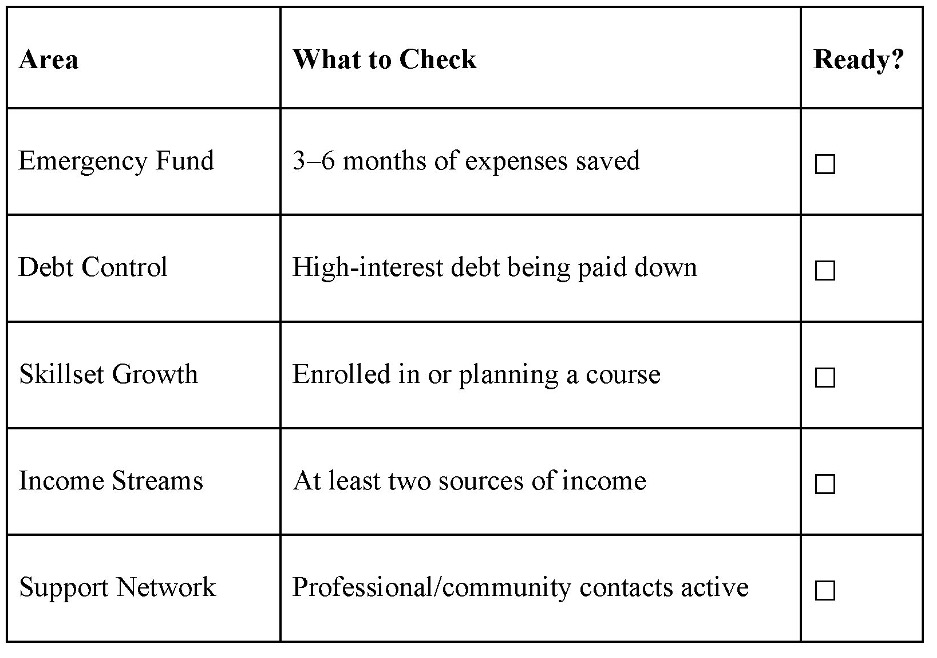

Am I Recession-Ready?

Investing in Yourself (Even When It Feels Risky)

Economic uncertainty makes many people freeze. But standing still in a moving storm can be worse than stepping forward cautiously. Upskilling and education aren’t expenses — they’re resilience multipliers.

If you’ve ever thought about expanding your skillset, now might be the time. By choosing a Business Administration program, you can gain practical skills in management, communications, and accounting. Online learning programs make it possible to keep a full-time job while studying, helping you stay competitive as industries evolve.

Spotting the Hidden Opportunities

Some of the most successful ventures — from Airbnb to Uber — were born in recessions. Downturns force creativity and shift consumer habits.

Opportunities worth exploring:

- Freelance & consulting work: Platforms like Fiverr can turn skills into income.

- Small-scale entrepreneurship: Online marketplaces like Etsy or Shopify are ideal for testing ideas.

- Investing smartly: Consider Vanguard’s Investor Education for long-term, low-cost strategies.

- Community volunteering: Building goodwill and networks can lead to job offers later.

FAQ: Recession Survival Basics

Q1: Should I invest during a recession?

Yes — but cautiously. Focus on long-term, diversified investments rather than chasing “cheap” stocks.

Q2: Is it a bad time to change careers?

Not necessarily. Many industries grow during downturns — healthcare, logistics, and education often stay stable.

Q3: How can I protect my job?

Become indispensable: take initiative, stay adaptable, and communicate your value clearly.

Q4: Should I pay off debt or save more?

If your income feels unstable, prioritize savings first — liquidity provides flexibility.

Highlight: The Hidden Power of Online Tools

Sometimes thriving during a downturn simply means using the right resources. Tools like Basecamp help manage projects and track side hustles. Canva can help freelancers design professional materials, while Grammarly polishes communication. Tiny optimizations compound into major confidence and income gains.

Closing Thoughts

Recessions test resilience — but they also reveal hidden strengths. The people who emerge stronger are the ones who stay flexible, keep learning, and focus on value creation rather than fear. You can’t control the economy, but you can control how you adapt to it.

In short: Surviving is about endurance. Thriving is about evolution.

Katie Conroy is the creator of Advice Mine. She enjoys writing about lifestyle topics and created the website to share advice she has learned through experience, education and research.

The author tells the history of the Freedman’s Savings Bank, how it grew much too quickly, why it failed and the impact on Black America. The Freedman’s Bank offered a safe depository for formerly enslaved people, expanded quickly and gained millions in deposits – mostly ranging from $5 to $50. But inexperience and corruption doomed it to failure, costing may of the small depositors their savings.

The author tells the history of the Freedman’s Savings Bank, how it grew much too quickly, why it failed and the impact on Black America. The Freedman’s Bank offered a safe depository for formerly enslaved people, expanded quickly and gained millions in deposits – mostly ranging from $5 to $50. But inexperience and corruption doomed it to failure, costing may of the small depositors their savings.